Saturday, April 20, 2013

The Weekly Review

Extremely volatile week again, Eur/usd looks for a bearish turn while the Yen is pushing the Euro up. Aud/usd had a nice drop following that large pinbar. We shall see the new week if Aud/usd will breakdown or again push up which is very frustrating for trend traders. Eur/Jpy will be tricky also esp when there is the pinbar but sentiment is still bullish.

Sunday, April 14, 2013

The Weekly Review

Friday ended with some big movements. EUR/USD seems to have touched its weekly resistance while EUR/JPY had some pullback. On the weekly, EUR/JPY seems to have another potential of moving further up. AUD/USD will probably still in a limbo. We will see how will they unfold in the coming weeks.

Mapletree Logistics is still rallying at a crazy rate.

US Stocks

Dow Jones Index continues its rally.Singapore Stocks

Potential further upside for Kepland?Mapletree Logistics is still rallying at a crazy rate.

Commodities

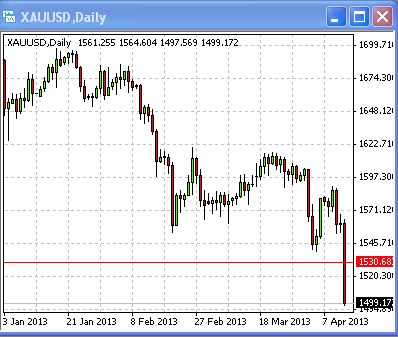

What made Friday the hottest topic that every trader was talking about was the price of gold. Gold was hovering on its support till probably some big bank sold big amounts of gold causing the breakout of its strong support. Gold might rebound and test it's new resistance. If it fails to break up, then I guess gold value will continue to fall and normalize, in the worst case senario at $1000.Friday, April 12, 2013

Sunday, April 7, 2013

Growing as a trader

Every trader has its own beginnings, his/her excitement, failures, frustration and fulfillments. But most of them go though the same stages where they grow into successful traders, or give up trading in the end.

Beginner Stage:

I started like every one else does, hearing about people making money from the stock market. So wanting to earn more, I started picking up books to read. There are so many books out there talking about investing, picking value stocks, how to calculate PE ratio etc. It got me excited. So after gaining all the knowledge, I went to open a trading account, made many calculations to find the valued Singapore stocks. Found a few, so I bought a few to try it out. What did I buy? Most of them penny stocks which I thought they will be gems cause they are really undervalued according to my calculations. In the end it did not rise as much as I expected, instead they all went down. I was invested during the peak of 2007 and the beginning of the biggest stock crash. Like a all emotional suckers, I held and held and the prices went further down. So I gave up and cut losses. Not a good start. Next tried another stock which seems to have a good value. Bought it and also came down. Everything crashed when Leman Bros. crashed. Pretty burnt.

Next stage.......... stay tuned.

Saturday, April 6, 2013

The Weekly Review: Making Yen Cheap

We had a very big rally this week thanks to the BOJ. JPY crosses were explosive. EUR sets for a comeback while the AUD/USD looks bearish. AUD now looks stuck at the support waiting for the breakdown. USD/JPY might continue to rally as it broke out of the high.

Has Amgen finally reached the top?

Genting on the lifeline.

Properties looking weak.

But REITS are still going strong.

Commodities

Gold had reached its major support and rebounded.

Let's take a look at the weekly.

Will gold rebound? Or will it breakdown and cause a gold panic?

US Stocks

Seems the Dow Jones Index fell last night and recovered. Still stuck in a consolidation range.Has Amgen finally reached the top?

Singapore Stocks

Singapore stocks looked very weak on Friday with most stocks plunging down.Genting on the lifeline.

Properties looking weak.

But REITS are still going strong.

Commodities

Gold had reached its major support and rebounded.

Let's take a look at the weekly.

Will gold rebound? Or will it breakdown and cause a gold panic?

Subscribe to:

Posts (Atom)